Some of you probably remember when your music came on vinyl discs. You brought your purchase home from the record store, placed the record on a turntable and dropped a needle into the grooves embedded in it. As the record spun, the needle, attached to a mechanical arm, transferred the vibrations in the groove to speakers.

Compact discs, storing sound electronically, replaced vinyl records. CDs, in turn, were soon made obsolete by the Internet. You now download the digital ones and zeroes, and play back the music from a smartphone.

What goes around comes around. Vinyl records have made a resurgence. They outsold CDs in 2023, the second time since 1987. Audiophiles claim they deliver better sound, warm and round compared to the cold sterility of digitized recordings.

The first sound recordings, developed by Thomas Edison in the 1870s, came on wax cylinders. These were too fragile for extended playing, though. Edison continued tinkering with the format, but others developed what we recognize as the disc record. By the 1900s, a shellac disc — very brittle — spinning at 78 revolutions per minute became the standard. A record ten inches in diameter could hold three minutes of sound per side; a twelve-inch disc, up to five minutes.

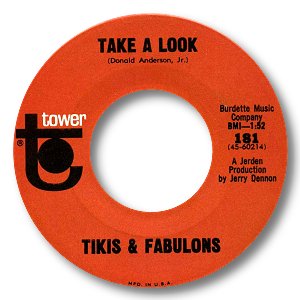

RCA Victor introduced the 45-rpm record in 1949. The seven-inch disc, with an inch-and-a-half hole in the center, carried one song per side. Arch rival CBS/Columbia Records introduced the long-playing record at about the same time. At 33 ⅓ rpm and twelve inch diameter, the LP could hold twenty minutes of sound. The LP was the medium for serious music for grown-ups.

Durable, easy to carry and easy to distribute to disc jockeys and inexpensive enough for a teenager’s allowance, the 45 became the vehicle for the rock-and-roll explosion. Portable 45-rpm record players made it easy for teens to share and enjoy their own music.

If you want to go down this particular rabbit hole, you can search 45database.com for artist, title, label and year for most 45-rpm records released — they weren’t “dropped” in those days — from 1949 to 1989.